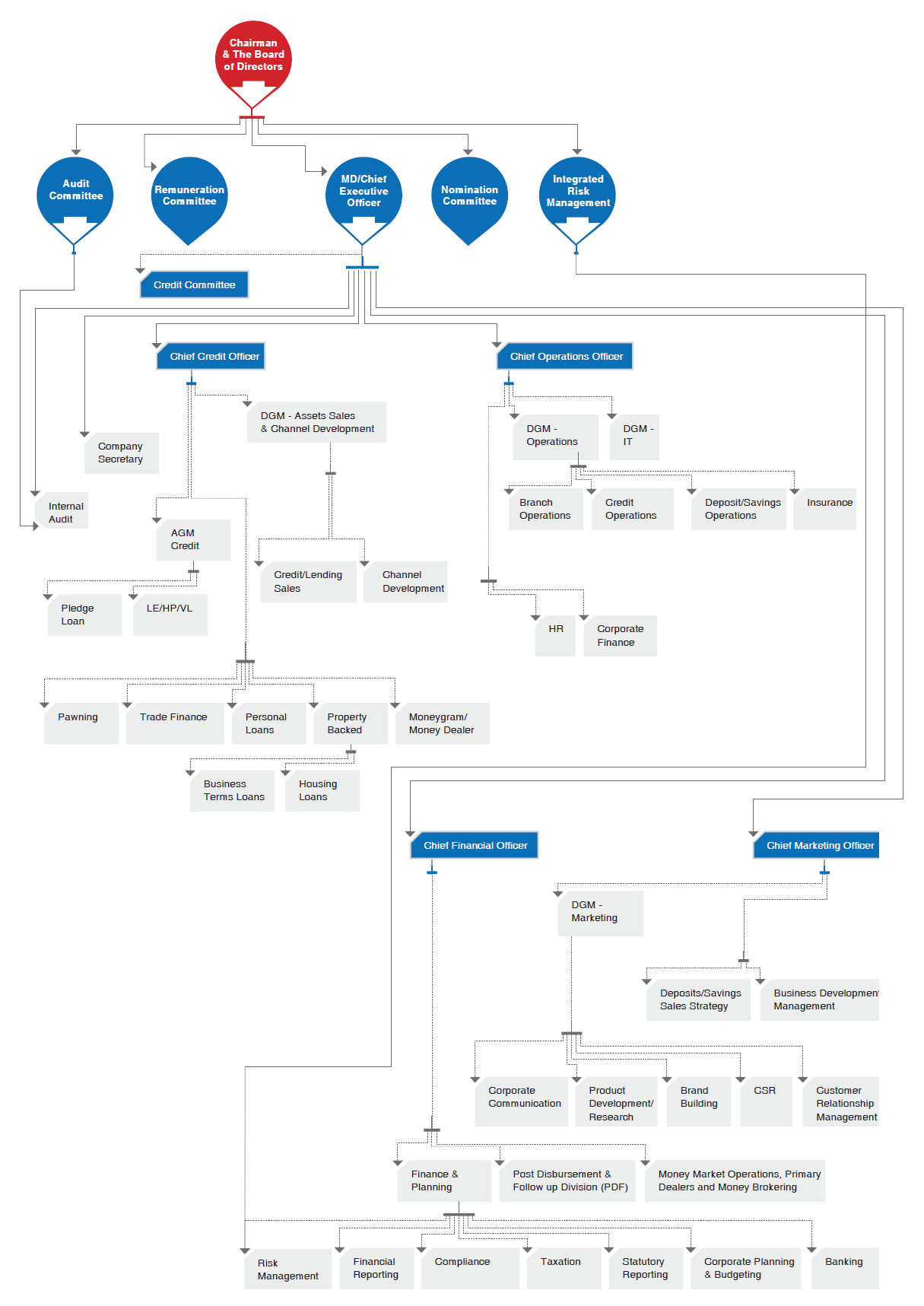

Organisation Structure

Overview

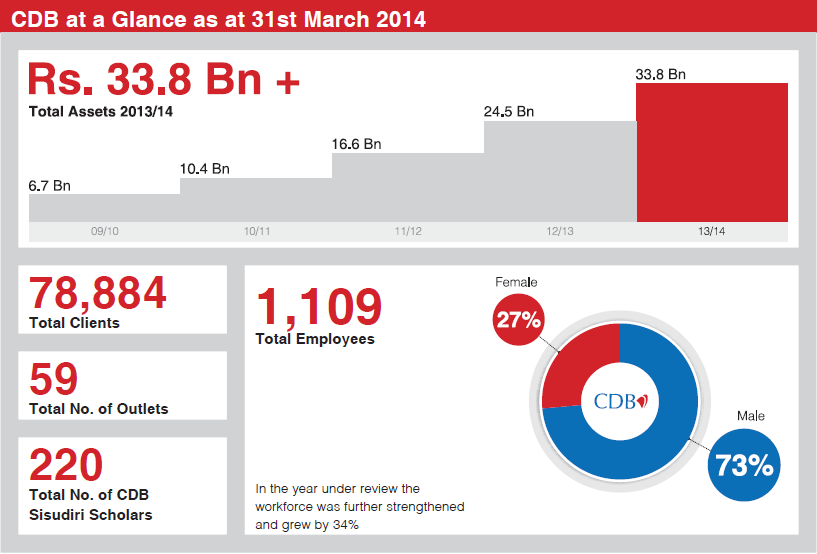

Citizens Development Business Finance PLC (CDB) is a registered finance company regulated by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange. Our business is that of mobilising funds and providing financial accommodations. Our total asset base as at 31st March 2014 was Rs. 33,769 Mn, with recorded revenue of Rs. 6,125 Mn, recorded net interest income of Rs. 2,342 Mn. Shareholders’ funds reached Rs. 3,577 Mn while borrowings stood at Rs. 4,314 Mn as at 31st March 2014. Coupled with an island-wide network of 59 outlets, these figures make CDB the sixth largest licensed finance company in Sri Lanka. The Company currently employs 1,109 people.

The Company’s business strategy is based on financial support for enterprise and industry that will build the nation’s economy and produce cascading, sustainable gains to improve the quality of life of all Sri Lankans. Our range of financial products is diverse and expansive, ranging from loans to foreign currency exchange and foreign remittances, from fixed and savings deposits to pawning. Thriving on the diversity of our clientele, our business model combines rural lending and urban funding.

Our sustainable development practices are those of a responsible corporate steward in the financial services industry, working to enrich both the planet and its people.

Organisation Structure

Report Boundary

Determining Material Matters

Material Aspects and Boundaries

Key to our goal of entrenching integrated sustainability across every facet of business is our focus primarily on those material matters and issues to our stakeholders. Determining these material aspects is an ongoing process, involving the study of all reports submitted for Board or Executive discussion, key business risk factors and identified opportunities, all formal and informal stakeholder feedback, our strategic objectives and integrated sustainability imperatives. The resulting material matters inform content priority for this Report and they are linked to our strategy and actions.

Materiality in financial reporting is the platform upon which stakeholders, predominantly investors, base their economic decisions. An organisation’s financial performance is inextricably linked to the performance of its triple bottom line, which has a permeating impact on all stakeholders. In CDB, determining materiality within the sustainability report is focused on the four main trusses of economic, environmental, social and cultural impacts. Hence, materiality in the sustainability reporting context is determined on significance of the mentioned economic, environmental, social and cultural impacts and influence on assessment and decisions of stakeholders. We have identified the material matters along with the material drivers for each stakeholder.

Our approach of addressing material aspects and boundaries is implemented through a vital process of stakeholder engagement. The very first step towards such aspects is identifying the relevant aspects and their boundaries. The following tabular format exhibits the identified material aspects and their drivers which matter to CDB within its scope.

| Factor | Material Matters | Materiality Drivers |

| Economic |

|

|

| Environmental |

|

|

| Social |

|

|

| Cultural |

|

|

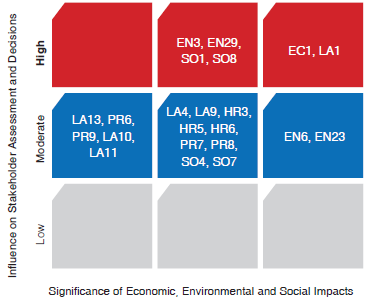

As the first step, we identify the most important and relevant aspects which could impact the organisation and hence, become material aspects for report content. Those aspects are then evaluated based on their significance to CDB’s sustainability context and their significance to stakeholders who are within and outside of the organisation. This leads to categorisation of such impacts as high, moderate and low and studying the degree of significance or the materiality of such aspects towards the performance of the organisation.

The following assessment demonstrates the aspect boundary for each material aspect within and outside of the organisation:

| Aspect | Aspect Boundary | Materiality | ||||||||

| Significance as per Sustainability Context |

Internal | External | ||||||||

| CDB | Employees | Customers | Social and Environment | Suppliers & Business Partners | Regulators | To CDB | To Stakeholders | Reported | ||

| Economic | ||||||||||

| Economic Performance | H | ∆ | ∆ | ∆ | ∆ | ∆ | ∆ | H | H | Yes |

| Environment | ||||||||||

| Energy | M | ∆ | ∆ | M | M | Yes | ||||

| Effluents and Waste | M | ∆ | ∆ | M | M | Yes | ||||

| Social: Labour Practices and Decent Work | ||||||||||

| Employment | H | ∆ | ∆ | ∆ | H | M | Yes | |||

| Labour/Management Relations | M | ∆ | ∆ | M | M | Yes | ||||

| Training and Education | M | ∆ | ∆ | M | M | Yes | ||||

| Equal Remuneration for Women and Men | M | ∆ | ∆ | M | M | Yes | ||||

| Social: Human Rights | ||||||||||

| Non-Discrimination | M | ∆ | ∆ | M | M | Yes | ||||

| Child Labour | M | ∆ | ∆ | M | M | Yes | ||||

| Forced or Compulsory Labour | M | ∆ | ∆ | M | M | Yes | ||||

| Social: Society | ||||||||||

| Local Communities | M | ∆ | ∆ | M | M | Yes | ||||

| Anti-Corruption | M | ∆ | ∆ | M | M | Yes | ||||

| Anti-Competitive Behaviour | M | ∆ | ∆ | M | M | Yes | ||||

| Compliance | M | ∆ | ∆ | M | M | Yes | ||||

| Social: Product Responsibility | ||||||||||

| Marketing Communications | M | ∆ | ∆ | M | M | Yes | ||||

| Customer Privacy | M | ∆ | ∆ | M | M | Yes | ||||

| Compliance | M | ∆ | ∆ | M | M | Yes | ||||

H - High M - Moderate L - Low

As displayed, the materiality aspects for CDB has been summarised using the following matrix-based on two options of influence on stakeholder assessments and decisions and significance of economic, environmental and social impacts. The importance of such aspects we wish to achieve shows the accountability of being a corporate citizenship to the economy, environment and society and the importance of the aspects of various stakeholder groups and the influence they could have on stakeholders’ assessment of the engagement with the Company. This will entail us to identify the stakeholders’ interaction and expectation level where the Company could perform a comprehensive assessment for the future.

Operating Environment

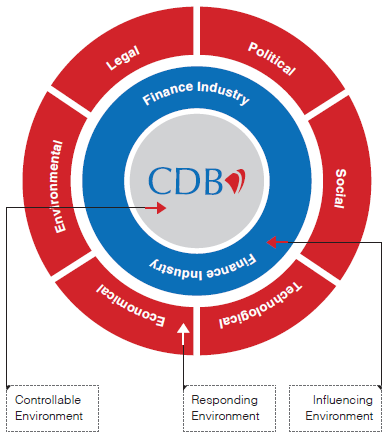

Our operating environment consists of the set of external entities, conditions and forces that have the potential to affect what we do and the results we achieve. Analysing the many different elements of the environment is difficult, the more so since many issues are interconnected.

The following PESTEL (political, economic, social, technological, environmental, legal) analysis visualises our operating environment as three concentric rings in which all the foregoing elements are manifest. The innermost ring comprises factors and effects under our direct control. The next ring is the realm of day-to-day influences and impacts upon our own business, which are more or less amendable to exploitation or mitigation. The outermost ring consists of major factors that impact to a greater or lesser degree on all organisations in the environment and are for the most part beyond our control.

Using this methodology, CDB’s operating environment may be analysed as follows:

| Environment | Influencing Factor | CDB’s Response |

| Political |

|

|

| Environmental |

|

|

| Social |

|

|

| Technological |

|

|

| Economic |

|

|

| Legal |

|

|

More information on environmental factors influencing operations in 2013/14 and our response to them is given in the Management Discussion and Analysis.

Sustainability Development

Rapid, Sustainable and Inclusive Development

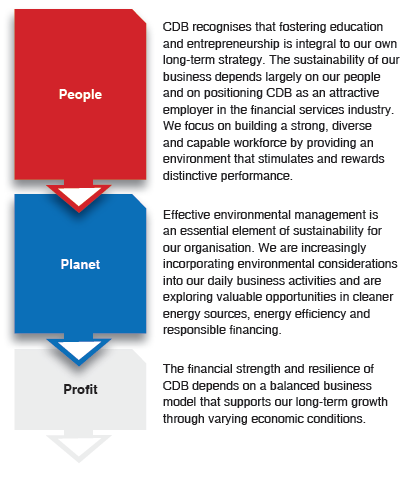

CDB takes up the charge to decrease the adverse impacts on our environment. It is obviously a multi-dimensional effort to balance what is best for the sustainable environment as well as what is best for the business. As consumer awareness and regulatory constraints increase, the focus of ‘right thing to do’ has shifted towards ‘best thing to do’.

Sustainable development ties together concern for the carrying capacity of natural systems with the social and economic challenges faced by the human beings. CDB strongly believes in constructing and nurturing strong, sustainable long-lasting relationships with its stakeholders. We also believe that this can only be achieved by recognising, understanding and respecting interests of all major stakeholders such as customers, employees, Community, Investors, business partners and the regulators and aligning those interests with our organisational growth oriented goals. We have deepened our commitment to operating in a way that meets the highest business standards. This commitment drives us to make a strong positive and sustainable difference towards the community. The commitment to social responsibility starts with the Board of Directors and extends throughout the business. Meeting current business needs while incorporating innovation and long-term thinking into our business models to meet the future needs of our stakeholders has made us a sustainable business.

To CDB, sustainability is an integral component which is not limiting to a paper or a report. We are forced to understand ourselves and the way the world works. We are urged to address the issues and find sustainable workable solutions for these because sustainable development involves more than simply growth. It means we have to change our mindset, the way we think, act and work. This means taking stock of our ecological capital, prompting more equitable income distribution and working on measures that will reduce vulnerability to economic crises. And this is where, CDB unites its corporate values along with the sustainability thinking as a foundation of our game plan.

Statement of Value Added

For CDB, sustainability is about building our businesses to ensure we have a positive impact on the economic and social progress of communities and on the environment, while growing and preserving clients and stakeholders’ wealth based on strong relationships of trust. This commitment to sustainability means integrating social, ethical and environmental considerations into our day-to-day operations. A key element of this is solid corporate governance that ensures sustainable management with long-term vision.

Paradigm Shift to Sustainable Capitalism

Management Approach on Economic, Social and Environmental consideration has become our key theme in managing economy, society and environment. Beyond such effort what we believe is we require the sustainable business community to join the ongoing system level conversations on how to make the whole economy truly sustainable. As we have crowned as one of the most trusted entities and an employer of choice in the sector we have embraced the accountability on building a sustainable surrounding for all the entities existing.

The holistic approach model of CDB shows its responsibility towards naturality, building a sufficient economy and nurturing community along with the accelerator of philosophies, strategies and priorities.

| Philosophy | Strategy | Priorities |

|

Focus on meeting economic, environmental and social sustainability dimensions in accordance with the triple bottom-line approach Expand into the challenging markets of leasing, deposit mobilisation and micro-finance. |

To promote, establish, expand and modernise the industrial, agricultural and commercial sectors, thereby contributing to the overall development activities in Sri Lanka. To exceed stakeholder expectations and delivering sustainable products and services, thereby emphasising the need for safe and responsible living. To ensure our operating standards are consistent and equivalent throughout our island-wide branch network, as we believe this will contribute towards positively impacting our environment. |

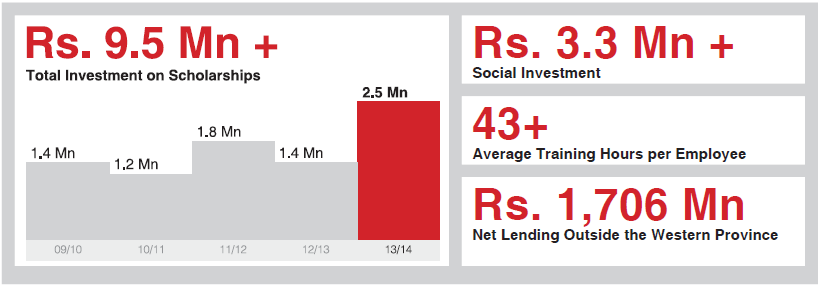

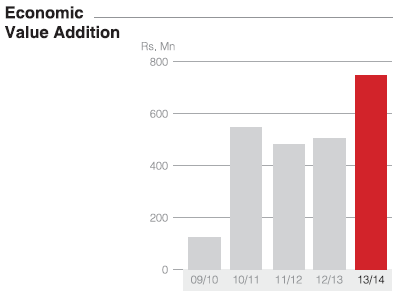

Economic Value Addition - Reaching Economic Sustainability

As our shared assets are not sacrificed for short-term profit we are mainly concerned on economic value addition where it enables local economic development, poverty alleviation, social and economic transformation, environmental stewardship and infrastructure development.

The Board of Directors guides CDB’s approach to economic sustainability with a comprehensive corporate policy and procedures. The combination and ongoing relationships among each single unit’s processes discuss on specific goals and resources allocated according to our overall targets. The chapters on Corporate Governance and the Risk Management provide a detailed review on economic sustainability.

The material concerns on formulating and implementing Company’s strategic direction, risk assessment and response, control of operations - internal control system, regulatory framework, legislation and code of conduct, corporate social responsibility and other external factors are deliberated at the monthly Board meetings. The internal audit function ensures integrity of the internal control systems, policies and procedures of the entire operation while the external audit assurance is taken in fulfilling requirements of the Companies Act.

The economic performance is therefore such a vital facet in determining economic sustainability where we have considered it as a material aspect as follows:

| 2013/14 | 2012/13 | |

| Rs. | Rs. | |

| Revenue | 6,125,161,547 | 4,311,850,070 |

| Operating costs | 936,602,568 | 688,836,869 |

| Employee wages and benefits | 497,938,442 | 407,018,893 |

| Payment to providers of capital | 3,715,050,534 | 2,529,859,968 |

| Payment to government | 226,757,864 | 176,094,843 |

| Community investment | 3,283,422 | 3,150,393 |

| Economic Value Generated | 745,528,717 | 506,889,105 |

Stakeholders

CDB has a broad range of stakeholders with whom it is actively engaged. To the best of our ability, we manage these relationships with the objectives of fulfilling social expectations, minimising reputational risk and influencing the business environment in a positive way. The frequency of engagement with stakeholders varies according to the group and particular issue under consideration.

Stakeholder Overview

| Stakeholder Group | Their Concerns | Our Responsibilities |

| Investors |

|

|

| Customers |

|

|

| Business Partners |

|

|

| Employees |

|

|

| Government & Regulators |

|

|

| General public |

|

|

| Environmental advocates and activists |

|

|

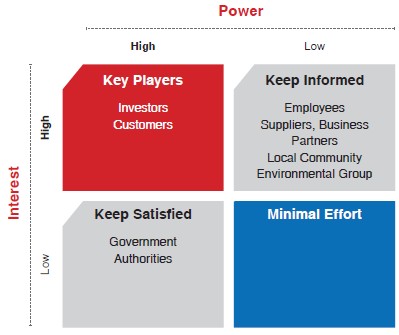

Prioritising Stakeholders

We promise a positive response by highlighting our commitment towards ensuring sustainability in our business. For our stakeholders, we give below the progress of addressing CDB’s social and environmental impacts in these relationships and promise a long-term commitment to such partnerships.

Prioritising stakeholders is based on the interest of each stakeholder in the business and the extent to which stakeholders can impact the activities of the organisation. Mendelow’s Matrix gives a clear mapping strategy which places stakeholders on the levels of power they have in impacting the organisation and their interest in doing so. It identifies the manner in which the management needs to respond to the stakeholders in different quadrants, which we at CDB use and apply in determining the basis for identification and selection of stakeholders.

High Interest and High Power

CDB identifies customers and investors to have a high influence on our business. They are the most powerful interest holders towards our operations. Any decision by them could have a considerable impact on the operations of the business. We maintain a constant engagement with these stakeholder groups as we strongly believe a strong relationship should be maintained with them at all times.

High Interest and Low Power

Employees, suppliers and business partners, citizens and environmental groups have a high level of interest in the business, even though the power they exercise is low. The strategy of engagement is to keep them informed of the activities, while keeping in touch for any feedback or suggestions they may have with regard to the business.

High Power and Low Interest

Government authorities including the Central Bank of Sri Lanka, Colombo Stock Exchange, Securities and Exchange Commission and Inland Revenue Department exert high power with their decisions in the direction of the business environment we operate in though they do not exercise a high interest. They observe the business’ operations intimately, monitoring compliance, codes of conduct and best practices which prompt us to ensure that we always exceed their expectations by maintaining the requirements.

Low Power and Low Interest

Given our sustainability philosophy and the high engagement we have with all our stakeholder segments including our communities, there is no stakeholder category that is aligned to a low power low interest group. We continue to maintain such interest towards our stakeholders in every aspect of our business and strive to ensure that all our stakeholders remain within that umbrella, where we respond to their expectations and needs and they in turn, become partners in our progress.

Stakeholder Engagement

1. Investors

Why do we need to engage with them?

Investors, who invest in our Company and elect the Board of Directors, are entitled to meaningful information about the Company’s business, policies and practices so that they can make informed decisions and knowledgeably participate in the proxy voting process. Investors motivation for engagement is mainly to gain insight into how CDB allocates resources to generate the expected return. We ensure the long-term corporate strategy will lead to superior financial performance. Early engagement with investors on key issues could lead to a reduced likelihood of unexpected consequences while addressing additional long-term operational strategies. By means of gaining both financial and non-financial excellence, it could increase investor trust.

How do we engage with them?

CDB’s strategic priorities based upon investors are woven around enhancing return on investments and obtaining external recognition through effective and efficient communication of business performance and achievements. We hope to foster more open dialogue with shareholders by offering a variety of avenues for shareholders to communicate with the Board and encouraging shareholders to contact us at any time of the year.

| Mode | Frequency |

| Annual Reports | Annually |

| Annual General Meeting | Annually |

| Interim Financial Statements | Quarterly |

| Media Releases | Available when needed |

| Corporate Website | Continuous |

| Announcements to CSE | Available when needed |

| Investor Forums | Available when needed |

2. Customers

Who are our customers?

CDB’s customers are mainly loyal depositors and borrowers. They tend to engage actively with us, forming strong, lasting relationships that facilitate responsible lending and cross-selling. Greater emphasis on transaction-led customer acquisition resulted in an increase in deposit customers in 2013 of 21%, which represents an increase in primary customer relationships.

We are reputed for tailoring solutions to customer needs. Since the financial industry, by and large, provides affordable solutions to economically active and easily accessible customers, CDB differentiates itself as a provider of solutions for customers who fall outside the mainstream.

Why do we need to engage with them?

- To gain a better understanding of their financial service needs and their perceptions, behaviour, attitudes and values

- To provide better advice and solutions to the financial needs they identify

- To ensure that their expectations with regard to service are met

- To verify the accuracy of personal information supplied

How do we engage with them?

- Product design, advertising and marketing

- Face-to-face interactions at CDB offices and branches

- Regular correspondence with account and facility holders

- Annual customer surveys

- Island-wide outlet network

- VISA debit card access

- Customer care and complaints handing services

- Website

| Mode | Frequency |

| Corporate Relationship | Ongoing |

| Area Development Officer | Ongoing |

| Dealer Network | Ongoing |

| Media Advertisements | Available when needed |

| Corporate Website | Continuous |

| Product Launches | Continuous |

3. Business Partners

Why do we need to engage with them?

- To maintain and enhance positive working relationships

- To share and involve them in our future plans

- To build a more diverse product portfolio through partnerships

How do we engage with them?

- Joint promotional campaigns

- Joint staff training, orientation, etc.

- Dealer network and marketing channels

| Mode | Frequency |

| Suppler & Business Partner Relationship |

Ongoing |

| Visits | Available when needed |

| Joint Promotional Campaigns | Available when needed |

| Suppler Product Displays at CDB Branches |

Available when needed |

4. Employees

Why do we need to engage with them?

- To ensure that the working environment we provide is safe and conducive to productivity

- To understand and respond humanely to the needs and concerns of our people

- To provide all staff with strategic direction and pertinent information

- To remain an employer of choice

How do we engage with them?

- Regular updates on Company performance and objectives through staff and departmental meetings

- Annual performance measurements and encouragement for career development

- Training, internal and external (including overseas)

- Recognition for outstanding performance at Annual Awards Ceremony

- Integrated HR system

- Annual social events for all employees

- Whistle-blower procedures and protection

| Mode | Frequency |

| Managers’ Meeting | Once a week |

| Branch Meetings | Once a month |

| Regional Review Meeting | Once a week |

| Special Events of CSR, Sports Events, Get-togethers etc. | Annually |

| Internal Announcements | Available when needed |

| Operational Updates to People via Email | Available when needed |

| HRM Enterprise Intranet | Continuous |

| Performance evaluation and reward based mechanism | Continuous |

5. Government and Regulatory Authorities

Why do we need to engage with them?

- To minimise operational risk

- To retain our various operating licenses

- To ensure we are in compliance with changing legal and regulatory requirements

- To maintain good relationships with the authorities

How do we engage with them?

- Conduct various forums on compliance meetings

- Board and management meetings, including one-on-one discussions with various officials

- Regular correspondence and reporting on compliance and other relevant issues

| Mode | Frequency |

| Directives and Circulars | Issued when needed |

| Meetings | Quarterly |

| Press Releases | Available when needed |

| Scrutinising New Rules and Regulations | Daily |

6. Local Communities and the General Public

Why do we need to engage with them?

- To obtain input from community regarding our business and how we conduct it

- To create awareness of our integrated sustainability commitment and initiatives

How do we engage with them?

- CSR activities and publicity

| Mode | Frequency |

| Wider Reach Outlets | Ongoing |

| Press Releases | Available when needed |

| Scholarships | Annually |

| Lab Donations | Annually |

| Investment in Community Development | Ongoing |

| Lending for Rural Economic Development | Ongoing |

7. Environmental Advocates and Activists

Why do we need to engage with them?

- To minimise the risks of negative publicity, lawsuits, customer boycotts, etc. due to accusations of environmental degradation, pollution, etc.

- To make use of their co-operation and expertise to develop more effective environmental policies

How do we engage with them?

- Adopt and publicise the green policies and practices we follow, such as our emission reduction programme, paperless operations and recycling, use of energy-saving devices and lighting, etc.

- Conform with (and where possible, improve upon) all current environmental laws and regulations

- Undertake and publicise relevant CSR projects, e.g. our successful wetlands conservation project

| Mode | Frequency |

| Emission Reduction | Ongoing |

| Paper Recycling | Ongoing |

| Mobile Mustering | Ongoing |

| CFL Bulb Recycling | Ongoing |

| Wetland Care Project | Annually |

Manage and Evaluate Sustainability Approach through Integrated Leadership

Our sustainability team aspires to provide the framework for environmental stewardship, natural resources conservation, emission reduction and community sustainability. The team acts as a resource to support and promote the business’ environmental commitment and policies. The team members further enhances awareness and understanding of the principles of sustainability among all people. Headed by a corporate management team member, it is a cross functional team from various levels and disciplines to ensure decentralised decision-making on expected targets.

The team remains committed to reduce our direct and indirect impact on the environment, and assisting our customers, suppliers and business partners to do the same, while simultaneously delivering economic benefits in the form of long-term cost savings. The continued contribution to socioeconomic growth and development remains a key focus which includes skills development, responsible access to finance and financial literacy, enterprise development, community upliftment and economic empowerment.

We employ a range of channels and mechanisms to gather stakeholder feedback. The frequency of engagement varies according to the stakeholder group and the particular issue. We use a decentralised stakeholder engagement model, in which individual business units undertake stakeholder engagement activities appropriate to their particular areas.

Our Stakeholder Relations Forum, comprising Business Unit Managers and Executives, meets every other month. It is responsible for facilitating a co-ordinated approach to stakeholder engagement activities across the Group, and ensuring we communicate a consistent message based on our Code of Ethics, values and strategy.

| Stakeholder | Area | Issue | Led by |

| Customers | Combined Content Standards & Privacy Customer Promise | Protect the privacy of our customers including data protection, confidentiality, preventing unsolicited communication and intrusive surveillance Provide a positive customer experience through innovative products and services |

Imdaad Naguib - Elangovan Karthik - DGM Marketing |

| People | Health, Safety and Well-being | Ensure that we properly safeguard those who work for us and those who may be affected by our operations | Roshan Abeygoonewardene - Chief Operations Officer |

| Environment | Environment Protection Energy |

Oversee the social investment fund to develop products and services that benefit society Reduce energy consumption and pollution |

Roshan Abeygoonewardene - Chief Operations Officer |

| Society | Social Investment | Contribute to enhance the standard of living of the society | Elangovan Karthik - DGM Marketing |

| Shareholders | Maximise shareholder wealth | To generate profits and to ensure that they get good returns for their investment | Damith Tennakoon - Chief Financial Officer |

| Government Authorities & Business Partners | Corporate Governance and Business Ethics Supply Chain |

Develop and communicate a framework that promotes good corporate governance and ethical behaviour at all levels Work with suppliers to address sustainability issues in the supply chain |

Damith Tennakoon - Chief Financial Officer Sasindra Munasinghe - Chief Credit Officer |

Value Creation and Capital Formation

Our objective of building an organisation that optimises returns to all stakeholders and creates a sustainable future is enabled by an integrated approach to the economics of the business, environmental preservation, involvement in society and organisational culture. Incorporating this approach, our value creation motive is woven around building a sustainable business targeting returns ahead.

The dual aspects of value creation - deriving value and delivering value - were discussed earlier under About This Report. We noted how value derived leads to internal capital formation, while value delivered leads to external capital formation. CDB has access to and makes use of all these forms of capital in driving future earnings.

We will now move into specifics. Our internal capital comprises financial capital and institutional capital. The latter is intangible, and includes the aspects noted below. Our external capital is derived from stakeholders, summarised into six forms of capital, namely, investor capital, customer capital, business partner capital, employee capital, Governmental and Regulatory Authorities capital and social and environmental capital.

| Capital Type | Aspects | Material Issues |

| Internal Capital | ||

| Financial | Revenue growth |

|

| Institutional | Listed brand |

|

| External Capital | ||

| Investor | Earnings per share |

|

| Customer | 59 customer outlets |

|

| Business Partner | Insurance companies and suppliers |

|

| Employee | 1,109 employees |

|

| Social and Environmental | Regulatory |

|

Macroeconomic Environment

The Global Economic Outlook: A Brittle and Uncertain Recovery

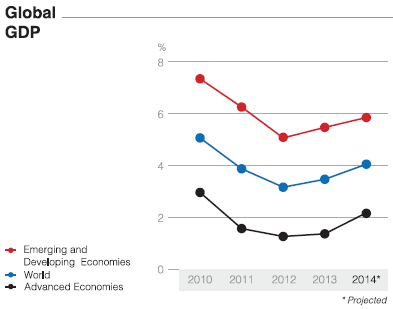

The jagged global recovery inched uncertainly forward in 2013. Events, viewed from a global perspective, revealed the far-flung effects of rich-world monetary policy: decisions by central bankers in developed countries reverberated through emerging markets. Because or in spite of this, world economic growth remained feeble, averaging only 2.5% during the first half of 2013, much the same as in the second half of 2012. For the first time since the Great Recession of 2008, formerly fast-growing emerging economies lost pace while developed nations gained momentum. Emerging market economies, however, continued to account for the bulk of global growth.

Support for global economic growth is expected to come mainly from the United States, where economic activity will move into higher gear as fiscal consolidation eases while monetary conditions remain supportive. Following sharp fiscal tightening earlier this year, activity in the United States is already regaining momentum, helped by a recovering real estate sector, higher household wealth, easier bank lending conditions and more borrowing. US fiscal tightening in 2013 is estimated to be 2.5% of GDP. However, this will ease to 0.25% in 2014, helping raise the rate of economic growth to 2.5% from an average of 1.5% in 2013. This forecast assumes that US discretionary public spending is authorised and executed as projected and that the debt ceiling is raised in a timely manner.

Global GDP Growth

Real GDP growth has been disappointing in both emerging and developing economies, but in advanced economies it has stayed broadly in line with projections. The reasons for weaker growth elsewhere differ from country to country and include tightening capacity constraints, stable or falling commodity prices, less policy support and slowing credit after a period of rapid financial deepening.

Future Outlook

Global growth is still weak: its underlying dynamics are changing and downside risks are high. Expected changes in US monetary policy could pose risks for emerging market economies, where activity is slowing and asset quality weakening of particular concern is the retardation of growth in China, which will affect many other countries, notably commodity exporters.

Elsewhere, old problems such as financial instability in the Euro Zone and worrisomely high public debt in all major advanced economies remain unresolved. Many emerging market economies need a new round of structural reforms. However, growth in the latter is expected to remain strong at 4.5%-5%, supported by solid domestic demand, recovering exports and conducive financial and monetary regimes. Despite the China slowdown, high commodity prices will continue to boost growth in many low-income countries, though many of them, particularly in Middle East, Western Asia and North Africa, will continue to struggle with difficult economic and political transitions.

Sri Lanka’s Economy: Growth Vs Inflation

Gross Domestic Product (GDP)

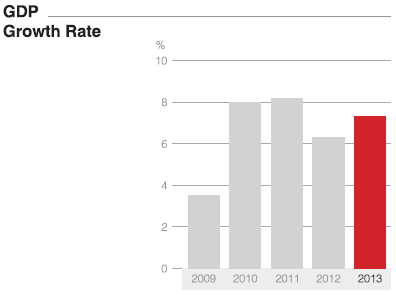

Year on year, GDP in Sri Lanka expanded by 7.3% in 2013. This was a commendable performance even compared with the ten-year average to 2013, which was 6.4%.

Power generation, which can constrain economic activity, picked up in May to grow by 9.2% but dropped slightly in June. Imports recorded positive growth in April and June as the deceleration in credit to the private sector showed signs of abating, while the service sector also showed signs of recovery. As a result, GDP growth rebounded to 6.8% in the second quarter from 6.0% in the previous quarter. The industrial sector maintained high growth but agriculture continued to suffer the effects of bad weather. These are expected to continue in 2014, an El Niño year.

Inflation Pressure

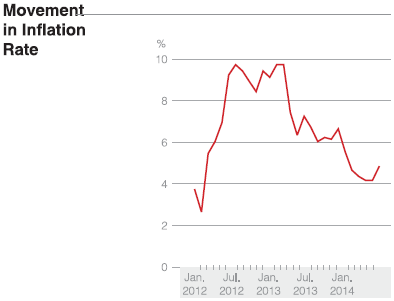

Inflation eased to 6.3% year on year in August from close to 10% in early 2013. Non-food inflation dropped below 4% in March-April but accelerated again to 6% in May as power tariffs rose. The Central Bank eased policy rates in December 2012 and again by 50 basis points in May, subsequently reducing the statutory reserve requirement by 2%.

Bank lending rates decreased from 14.4% in February 2013 to 12.1% in June, improving private sector credit mobilisation. Imports and exports both showed signs of recovery in the first half as a result. The trade deficit shrank by 7.1% from the second half of 2012. Workers’ remittances and earnings from tourism partly offset the trade deficit, with remittances growing by 9% in the first half. Financial inflows have been strong, with foreign direct investment amounting to $ 540 Mn.

Since June, the Rupee has been under pressure from greater import demand. Foreign holdings of Government Securities dipped in late August, further weakening the Rupee against the US Dollar. Sri Lanka’s gross official reserves equalled 4.1 months of imports in June 2013, down from 4.5 months in March. Looking forward, easier monetary policy and continued recovery in services will support stronger performance in the second half, though external trade is expected to remain weak.

So long as food prices remain stable, inflation in 2014 is expected to stay below 6.5%.

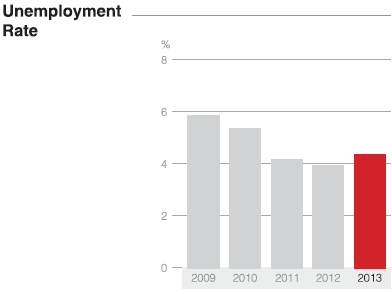

Unemployment

According to the Department of Census and Statistics, the rate of unemployment decreased to 4.4% in the second quarter of 2013, having reached 4.6% in the previous quarter. This reflects a broadly declining trend that has continued from an all-time high of 11.3% in 1996; from then until 2013, unemployment averaged 5.9%. Unemployment statistics record only those actively seeking work.

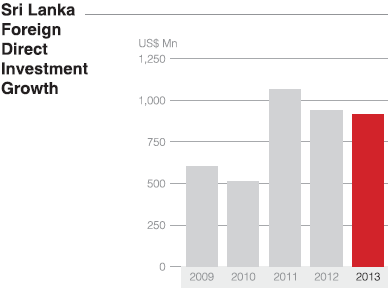

Foreign Direct Investment

Sri Lanka’s strong economic growth is attracting foreign capital, but Foreign Direct Investment (FDI) inflows remain modest compared with rated peers. This has led to rising external debt. During the first nine months of 2013, Sri Lanka received $ 870 Mn invested in 55 projects - a 41% increase over the same period in 2012. This indicates that overseas investors confidence in Sri Lanka remains firm.

This relative increase in FDI inflow does not represent a significant slice of global FDI outflow, which was around $ 1.33 Tn in 2012. Competitors such as Vietnam and India have done much better.

Future Outlook

According to an analysis by the Central Bank, Sri Lanka in 2014 will display the typical growth characteristics of a small developing country, with IT services, exports, tourism and remittances making significant contributions. With close to 6% of GDP derived from public investment in physical infrastructure (as announced in the 2014 Budget), growth will be chiefly Government-led and debt-financed, with some contribution from the private sector, for example in construction.

LIBOR rates will show an increase in 2014, making international commercial borrowing more costly. The government has announced the issue of a $ 1.5 Bn sovereign bond in 2014. Presumably, some of the funds so raised will be invested in infrastructure development while the rest will be used to meet debt and interest obligations.

The effect of sanctions, including the WTOs removal of the country’s GSP+ concession in 2010 and US sanctions against Iran (from where Sri Lanka has obtained crude oil on concessionary terms), continue to hobble the Sri Lankan economy. A free trade agreement with China, to be signed in 2014, will, it is hoped, help offset this.

Overall, Sri Lanka can hope to benefit from the accelerated growth of the global economy that has been forecast for 2014. The developing Asian region, of which the country is a part, is expected to grow by 6.5% in 2014 compared to 6.3% in 2013. However, the improvement may not manifest in full as 2014 is likely to be an election year, during which productivity is typically hampered. Overall, we may hope for growth of 7%-7.5%, a reasonably high rate from an Asian perspective.

Sri Lanka’s Finance Industry: The Challenge of Constant Change

CDB’s near operating environment is the complex of institutions, markets, instruments and infrastructure that constitutes the Sri Lankan financial sector. This environment is responsive to both internal and external change factors, on which its stability is largely dependent.

In 2013, the fragility of the global recovery and potential threats arising in the domestic economy did not unduly affect stability or discourage sector expansion. A cap on credit growth helped curb domestic demand and safeguard the economy, and there was a definite improvement in both capital and liquidity. Service and credit access improved across the country as institutions expanded their branch networks. Improved investor confidence was reflected in net inflows to the Colombo Stock Exchange despite relatively higher yields on fixed-income securities, volatility in the exchange rate, tight liquidity conditions and uncertainty in the global financial markets.

Future Outlook

Given sustained capital adequacy, healthy earnings, effective regulation and proper risk management, the financial sector is likely to maintain its stability, encouraged by a greater emphasis on efficiency and productivity. There is also a concerted effort to enlarge the capital market. A series of tax incentives is expected to spur growth, particularly in the corporate bond market. Plans are also afoot to liberalise exchange controls, allowing corporates to borrow internationally. There will be close monitoring of global paradigms and market sentiment.

Our Immediate Environment: The Non-Banking Financial Sector

Non-Banking Financial Institutions (NBFIs) in Sri Lanka are regulated by the Central Bank and play an important role in the financial sector. Not being subject to the statutory reserve requirements imposed on banks, they enjoy greater flexibility in governance and operation, although they are restricted in the services they can offer and in their funding options. The sector comprises licensed finance companies and specialised leasing companies.

Non-banking sector had positive outputs as the branch networks also expanded, indicating improved stability and soundness. Four new institutions were registered and a total of 206 new branches were added to the system, three-quarters of them outside the Western Province. Meanwhile, distressed finance companies were closely monitored by the Central Bank as they made progress in restructuring their operations. Unauthorised commercial lending was suppressed to the maximum feasible extent.

Future Outlook

NBFIs play a vital role in the Sri Lankan economy. With the country now experiencing strong growth, opportunities for this sector have increased. Many companies are, however, small, and the Central Bank has urged the sector to consolidate through mergers and acquisitions in order to gain the necessary financial resources and stability to address future opportunities. Indeed, the Bank is expected to increase substantially the minimum core capital requirement for NBFIs. Already, larger financial institutions in the private and public sector have shown interest in acquiring certain NBFIs, an encouraging development.

As Sri Lanka’s economy moves towards the $ 100 Bn benchmark over the next few years, NBFIs will become invaluable in promoting financial inclusion and developing entrepreneurship in all parts of the country - tasks they will be uniquely fitted to carry out following a necessary period of restructuring. NBFIs are ideally suited to serve SMEs, the agricultural sector and individuals, leaving banks free to concentrate on large-scale corporate, industrial and project finance.

Challenges facing NBFIs in the near to medium-term include interest rate pressures, inadequate credit controls and the reduced reliability of monetary aggregates as intermediate policy targets. Also, while NBFIs offer attractive borrowing rates, normally above those of banks, banks may in turn increase their borrowing rates to compete in markets traditionally served by NBFIs. Such pressure may reduce the effectiveness of policy-induced interest rate changes.