Structure

Readers will notice that our Annual Report 2013-14 adopts a different approach and structure. It is an integrated report; our very first.

Integrated reporting is a relatively new concept that is gaining acceptance globally. In adopting this approach, we have attempted to communicate more coherently and concisely how our strategy, governance, performance and prospects, in the context of our external environment, lead to the creation of value over time.

Conceptual Framework

Although the CDB Annual Report 2012/13 included a Sustainability Report, commencing with this Annual Report 2013/14 we have chosen to seamlessly integrate sustainability reporting with the rest of the report, as we regard ‘sustainability’ as being part of mainstream business.

In doing so, we have drawn on applicable concepts, principles and guidance given in the following:

- Global Reporting Initiative (GRI) Sustainability Reporting Guidelines G4 (2013) www.globalreporting.org

- The International Integrated Reporting Framework

(2013) www.theiirc.org

and the - Smart Media Methodology for Integrated ReportingTM www.smart.lk

The Dual Aspects of Value Creation

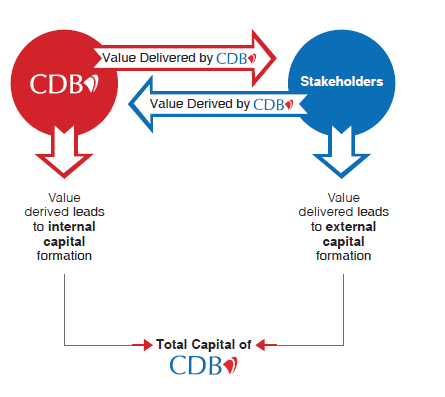

Value creation has two angles. It arises from the realisation that the ability of an organisation to create sustainable value for itself is also linked to the value it creates for its stakeholders. The two go hand in hand.

CDB delivers value, both financial and non-financial, to its key stakeholders in the context of the economic, social and environmental parameters within which it operates. These stakeholders are of value to us, and they are nurtured and developed over time. As stores of value, they constitute CDB’s stakeholder or external capital, the primary components being investors, customers, business partners, employees, regulators, society and environment. These forms of capital are external to CDB.

In turn, CDB derives value through the dynamic interaction between its external capital and its own internal capital to drive future earnings. The capital internal to CDB comprises financial capital and its institutional capital. The latter includes intellectual property, knowledge, systems, procedures, brand value, corporate culture, business ethics, integrity and the like.

Capital Formation

The various forms of capital are in a state of flux with flows taking place among them. CDB has access to and makes use of these various forms of capital in creating value for itself (deriving value) and its stakeholders (delivering value). They underscore the dual nature of value creation as depicted in the above diagram.

Content Development

In keeping with the need to keep this report both comprehensive and concise, we are disclosing only the key material aspects in the printed Annual Report 2013/14, while additional details are given in our online report that may be accessed at our website www.cdb.lk. We have chosen to be an early adopter of the GRI G4 Guidelines and this is our ver y first integrated report thereunder ‘in accordance with core criteria’. While our first sustainability report in 2010/11 was based on GRI G3 Guidelines, we evolved over time and the sustainability reports for the years 2011/12 and 2012/13 were based on GRI G3.1. This year, we have changed and re-evaluated materiality based on the guidance provided in the GRI G4 Guidelines under the ‘identified material aspects and boundaries’ covering our operational aspects. This report primarily covers sustainability impacts, risks and opportunities arising from financial operations within the organisation while spotlighting materiality, stakeholder inclusiveness, completeness and sustainability context, even as its quality is ensured through balance, comparability, accuracy, timeliness, clarity and reliability, all in accordance with the GRI G4 Guidelines.

External Assurance

For the second consecutive time, this year’s Annual Report receives independent external verification from KPMG, with regard to the financial data and performance indicators. CDB including our Board of Directors and senior management does not have any relationship with Messrs KPMG who is the External Auditor of the Company. The Managing Director who is an Executive Director and member of the corporate management team responsible for sustainable practices and disclosures reviewed in this report interacted with the external assurance provider in the report content.

Significant changes and restatements, with regard to the scale, size, structure, scope, boundary or measurement techniques, have not been made. The financial data presented in this report was extracted from the Audited Financial Statements of the Company for the year from 1st April 2013 to 31st March 2014. Non-financial data has been extracted from records maintained by the relevant divisions of the Company throughout the year. We have restated previous years’ data, wherever applicable, to enable greater comparability amongst years. Given that the Company is service oriented, certain GRI G4 performance indicators have been deemed inapplicable. Furthermore, CDB’s subsidiary, CDB Micro Finance Limited was excluded from this report, as it is in the process of merging with the Parent Company and thus is beyond the purview of this report. Also, certain non-core activities such as payroll services, security services, janitorial services and office equipment maintenance services have not been considered for the purposes of this report and are therefore excluded from the report scope which can be stated as a limitation.

Compliance

CDB’s Annual Report 2013/14 covers the 12-month period from 1st April 2013 to 31st March 2014, and is consistent with our usual annual reporting cycle for both, financial reporting and sustainability reporting.

The information contained in this report, as in the past, is in compliance with all applicable laws, regulations and standards as well as guidelines for voluntary disclosures.